Monthly Update, November 2023

View Tearsheets here: PERFORMANCE DETAILS

Click here to view the latest presentation.

The Big Picture

A massive rally hit the equity indices shortly after reaching new multi-month lows. We have mentioned repeatedly our opinion that the indices, particularly the S&P, are in the middle of an extended sideways trading range. We believe that the low which occurred in late October will likely be re-tested, and that the current upward trajectory is not sustainable.

From a supply and demand perspective, demand finally outstripped supply after a three-month movement lower. The result was an unexpected move higher that built on itself as panicked short sellers added fuel to the rally.

In our education on market movements, we have learned that sustained advances in the markets begin with a rejection of lows - but following that an equilibrium between buyers and sellers is established. This manifests as a sideways movement with declining volatility. November is showing the opposite of this, and we see it as a bull trap.

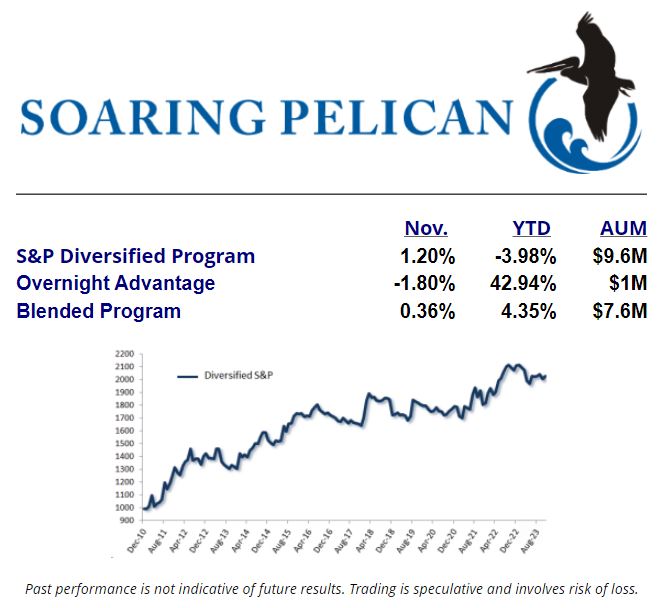

Recent Program Performance

All programs experienced lower activity during November due to the very unusual phase of the market. Reward potential did not justify risk, and our models will only enter when we have a strategic, proven advantage. In these cases we are glad to be on the sidelines and preserve cash.

Our Outlook

The bullish momentum of the past month is likely to draw in participants at the worst possible time, we see a classic whipsaw as a very high probability. These are difficult markets to navigate, but the systematic approaches we use remove our subjectivity and allow us to engage in high probability trades.

Best regards,

Sam Beckers and Dario Michalek

Soaring Pelican, LLC

805-322-7393

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. FUTURES TRADING IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK.