How Can Managed Futures Help My Investment Portfolio?

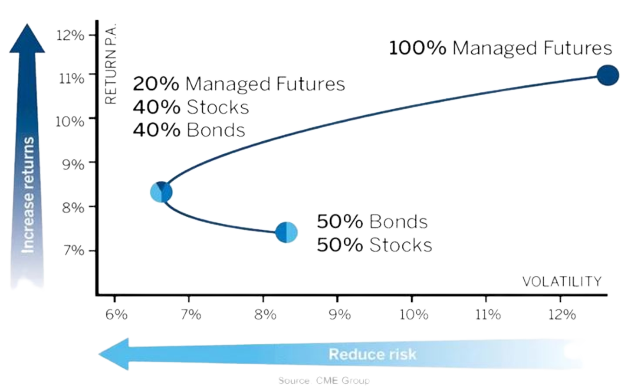

A key benefit of managed futures returns is the low correlation to traditional equity and bond investments. This is important because well constructed portfolios consist of investments or asset classes that do not move in tandem with each other and are uncorrelated to each other. Low correlated investments are expected to perform independently of traditional investments under the same economic events and market forces.

Who Invests in Managed Futures?

Institutional investors have invested in managed futures since the mid-1980s. Since then, assets under management in managed futures programs have grown to $400 Billion. Today, a wide range of investors utilize managed futures as a portfolio hedge, from retail and high-net worth to institutional investors.

In an environment with limited options for positive returns, many investors have been looking for strategies that can add value by providing protection in a negative market. Managed Futures has demonstrated its ability to reduce the overall risk of a traditional portfolio, creating a smoother ride for the investor and making it a smart choice.

Trading futures involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial situation.