Monthly Update, March 2025

View Tearsheets here:

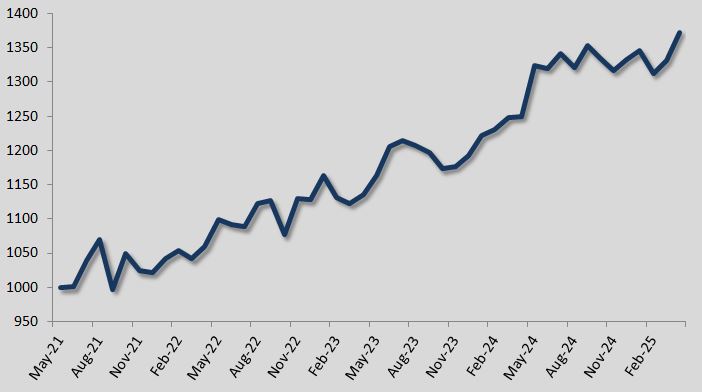

PERFORMANCE DETAILS - Soaring Pelican

Click here to view the latest presentation

March Performance & Volatility Insights

The Soaring Pelican Blended Advantage program gained 1.41% in March, while the S&P 500 dropped by around 6% during the same period. We’ve talked before about how volatility can benefit our trading strategy, and now we want to explain how that actually works.Some clients with stock-heavy portfolios might ask, “Shouldn’t you guys be hitting it out of the park when stocks fall?”. It’s a fair question, but the answer isn’t quite that simple.If we only focused on short-selling, then yes, we might see bigger gains during market drops. But our approach is different. Soaring Pelican looks for opportunities in both rising and falling markets. In fact, some of our biggest wins come when we go against the overall market trend. This typically happens when the market is overloaded in one direction and then snaps back sharply and unexpectedly.We’re not trend-followers—we’re strategy-driven.When volatility spikes, it creates more trading opportunities, but that doesn’t automatically mean bigger gains. That’s because our main goal is to provide clients with a smooth, steady equity curve—no big surprises at month’s end.To keep risk consistent, we reduce our position sizes during volatile periods. So while we may have more trades happening, each one carries the same risk. Yes, there’s always the chance of a big win (a "home run") in a volatile market, but that often comes down to timing and a bit of luck. It’s also common to be right on the direction of a trade but still get “whipsawed” and take a small loss.