Monthly Update, January 2024

View Tearsheets here: PERFORMANCE DETAILS

Click here to view the latest presentation.

The Big Picture

The Rally that would not die! We'll admit it, we didn't think it would last this long, and it has exceeded our price targets. Technology had led the way until only recently, and small cap. stocks are lagging. The markets continue to be led by a relatively small number of issues, which means that breadth is weak in this move. Typically, this means market health is poor, but there is no way to know how or when this situation will correct itself.

On a fundamental basis, inflation has fallen dramatically but remains above the target of the Fed. Reported jobs growth seem strong, but most jobs created are part time so this metric is deceiving. One red flag is that personal savings are very low, while revolving consumer credit has really spiked higher since Covid times.

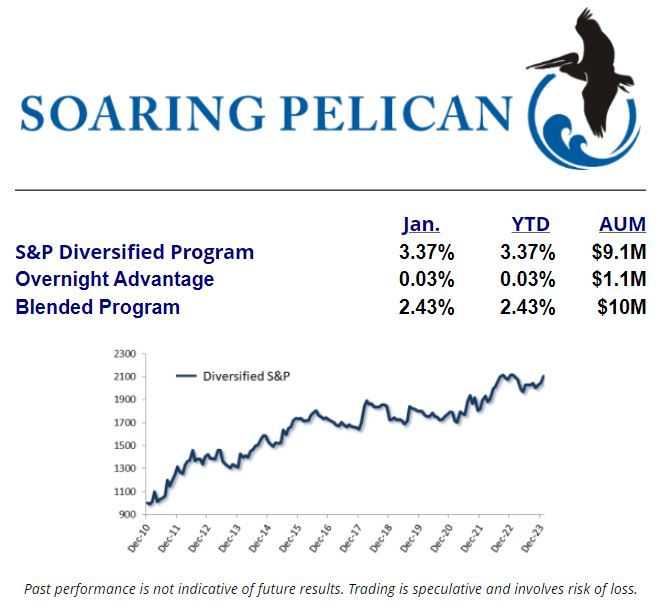

Recent Program Performance

All programs performed well in the latter half of 2023 and January. January had a rough beginning but as volatility built, we put together some amazing trades. Volatility continues to trend higher, which bodes well for our style of trading on all time frames.

Our Outlook

It is very difficult as a contrarian to be bullish in this market, as we know that this is a game of musical chairs that could end at any time. The legs that this rally was built on are flimsy indeed and fundamentals do not paint a rosy picture. We continue to follow our signals instead of our intuition.

Best regards,

Sam Beckers and Dario Michalek

Soaring Pelican, LLC

805-322-7393