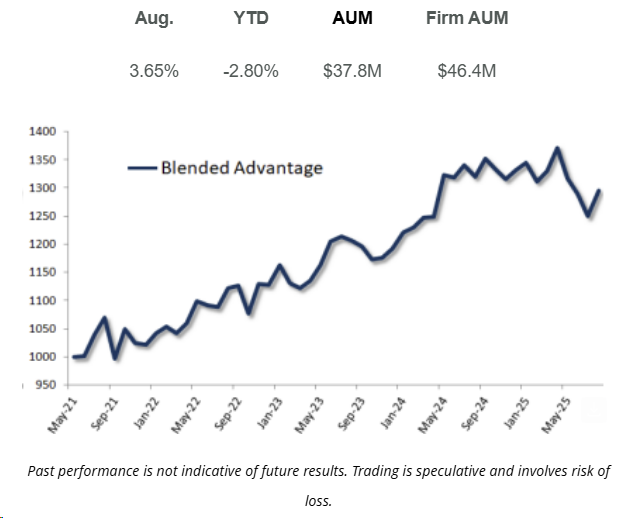

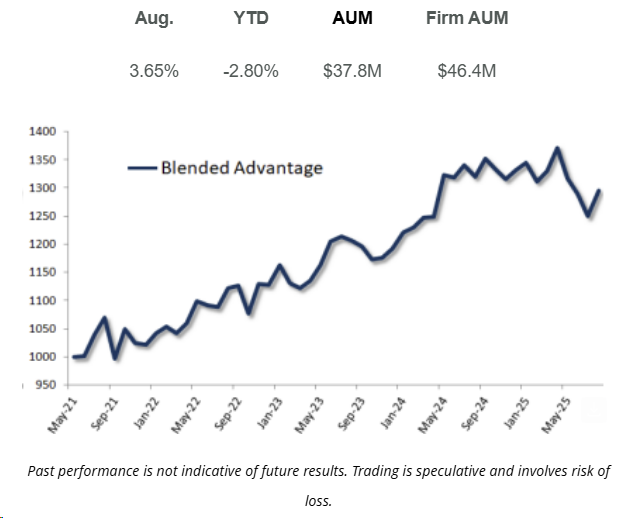

Recent Program PerformanceWith volatility remaining subdued, our overall performance has been restrained this year. The multi-day component of our strategy continues to deliver strong results, while intraday trading has largely been a pattern of “one step forward, one step back” over the past few months.This environment can shift quickly, and the S&P 500 is well known for sudden volatility surges. Because volatility is the primary driver of our returns, trading activity will stay muted until conditions pick up. Fortunately, market sentiment rarely stays calm for long — and the fall season is historically one of the most volatile periods of the year.

|

|