The Big Picture

The S&P continues to show strength and resilience, even after a healthy pullback during the month of April. The US dollar, Gold, and Bitcoin have all performed well over the past few months, which is notable since these markets tend to have lower correlation.

Essentially, making money in the stock market has been easy this year. ETF and mutual fund inflows are reaching multi-year highs and individual investors are likely feeling pretty good about their equity portfolios.

From a contrarian standpoint, a confident market is ripe for a pullback. While we acknowledge the current uptrend situation, there are some structural weaknesses in the recent rally that indicate that a deeper pullback is warranted.

Trailing stops are a great way to participate while maintaining an exit plan.

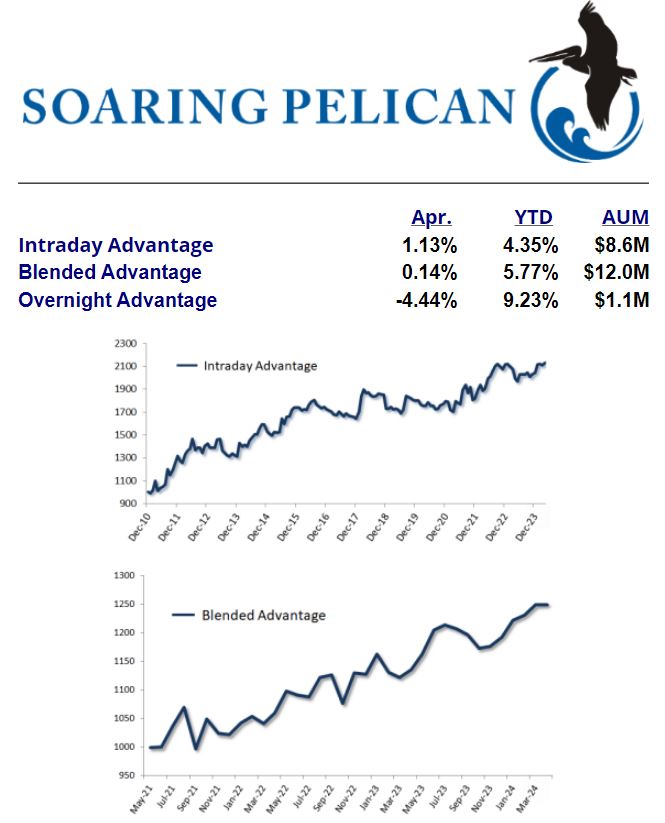

Recent Program Performance

New volatility entering the market was ideal for the Intraday Advantage program. The Overnight program took some long positions and was stopped out as we contained the risk of a small pullback turning into a larger one.

It is quite common for the Overnight program to pullback when intraday trading takes off. Our Blended program creates an ideal allocation between the two timeframes. Historically this has lowered account volatility and increased risk adjusted returns. We see this as our best offering.

Our Outlook

We mentioned in our last letter that a pullback was overdue, and we saw a decent one. Continued sideways to lower market action would better prepare the market for another move higher - but given the resilience of market activity this may not happen. As of the writing of this letter the market is at a critical balance point.

Best regards,

Sam Beckers and Dario Michalek

Soaring Pelican, LLC

805-322-7393 |

|